In March of 2020, McKinsey conducted a worldwide consumer survey to understand the impact of COVID-19 on consumer sentiment, consumer behavior, and the digital transformation of the industry. The impact of these rapid changes has not been the same for all consumer goods companies. Some dealt with a tremendous decline in sales/profit and unfortunately had to lay off thousands of employees, whereas other companies succeeded and thrived through the pandemic to grow and accelerate. But what was the key difference between these two different outcomes? Digital Transformation. Digitization, online ordering and delivery, and remote working became widespread overnight. New trends that might have taken a decade to come to life happened in days. Here are the new ways that have changed the industry forever.

Five Major Changes in Consumer Spending

-

- Shift to value and essentials

- Consumers are more mindful of their spending and buy less expensive products.

- Increased focus on household essentials; cutting back on most discretionary categories.

- Increased digital and omnichannel presence

- Most consumer industries have seen more than 10% growth in their online customer base through COVID-19.

- Most plan on shopping online with the use of e-commerce.

- Decrease in loyalty

- Many consumers have tried different brands due to supply-chain disruptions.

- According to Mckinsey, “Our research shows that in China and the United States, 75% or more of consumers reported trying a new shopping method.

- Health and “caring” economy

- Consumers buy more from companies and brands that have healthy and hygienic packaging as well as demonstrate concern for employees and customers.

- Homebody economy

- In most countries, more than 70% of survey respondents did not feel comfortable resuming their normal out-of-home activities (2020).

- Shift to value and essentials

How COVID-19 has Changed Consumer Behavior

Rapid shifts have heavy implications on retail and consumer goods companies. Three main changes have occurred because of COVID-19:

-

- Covid-19 is transforming consumers’ lives

- Three change forces: Economic downtown, preference shifts, and digital acceleration

- Behavior changes are not linear, and their stickiness will depend on satisfaction with the new experiences

- The Future is now: Players should prepare

- Prepare for consumption declines or trading down

- Address footprint offer and shopping experience for new reality

- Follow consumers in their new decision journeys when marketing and communicating

- Covid-19 is transforming consumers’ lives

Behavior changes will reshape consumer decision journeys, and companies will need to adapt fast

Retailers will face challenges across multiple departments. Here are some of the challenges Sales, Marketing, and Assortment are facing.

Sales

-

-

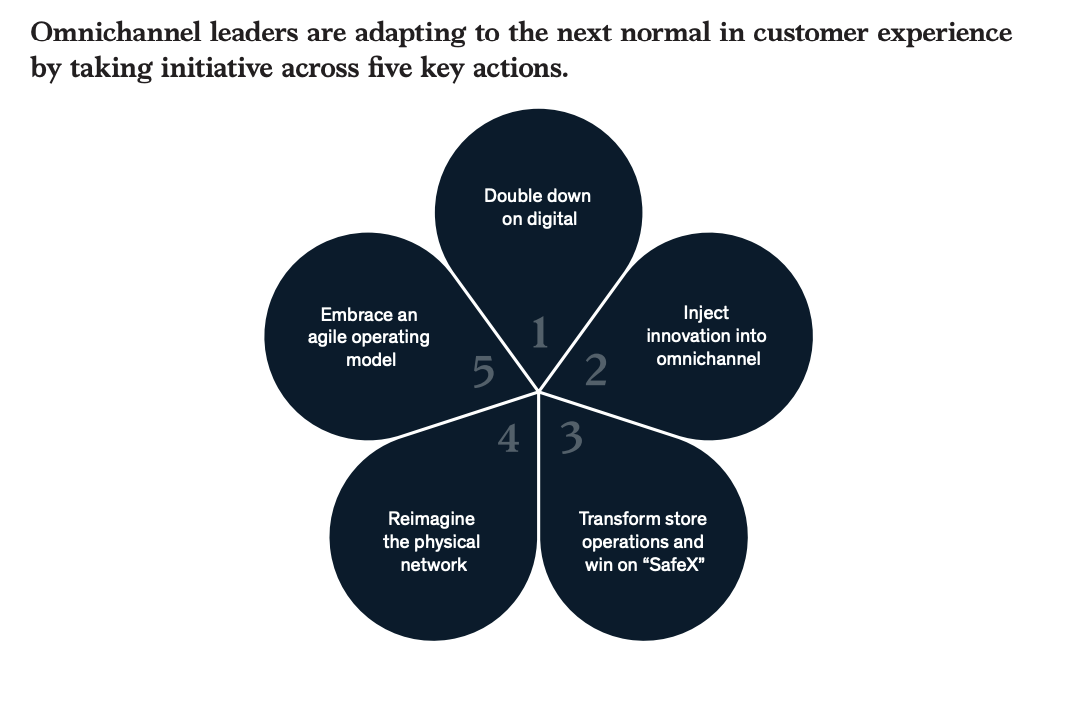

- Reinvented shopping experience: hassle-free shopping in a high-hygiene environment; change store layouts and proposition, reconfigure checkout, per longer operating hours, omnichannel experiences.

- Right-size network to recognize 15% drop in consumption.

- Leapfrog digital capabilities toward first-class e-commerce, consider drive-through, click-and-collect.

- Reevaluate physical-store footprint as traffic from professionals and tourists declines and affects travel retail and on-the-go consumption.

-

Marketing

-

-

- Consumers have changed where and how they engage, and marketing spending should reflect this.

- Stay relevant across multiple touchpoints (brand.com, platforms, e-retailers, own stores, multibrand stores).

- Allocate resources in line with journey shifts; eg, increase digital engagement (social, influencers, D2C) away from out-of-home advertising, print, trade marketing.

- Win in loyalty shifts: ensure a first-class customer-relationship-management system, foster trust through communication, and provide incentives for first-time shoppers.

-

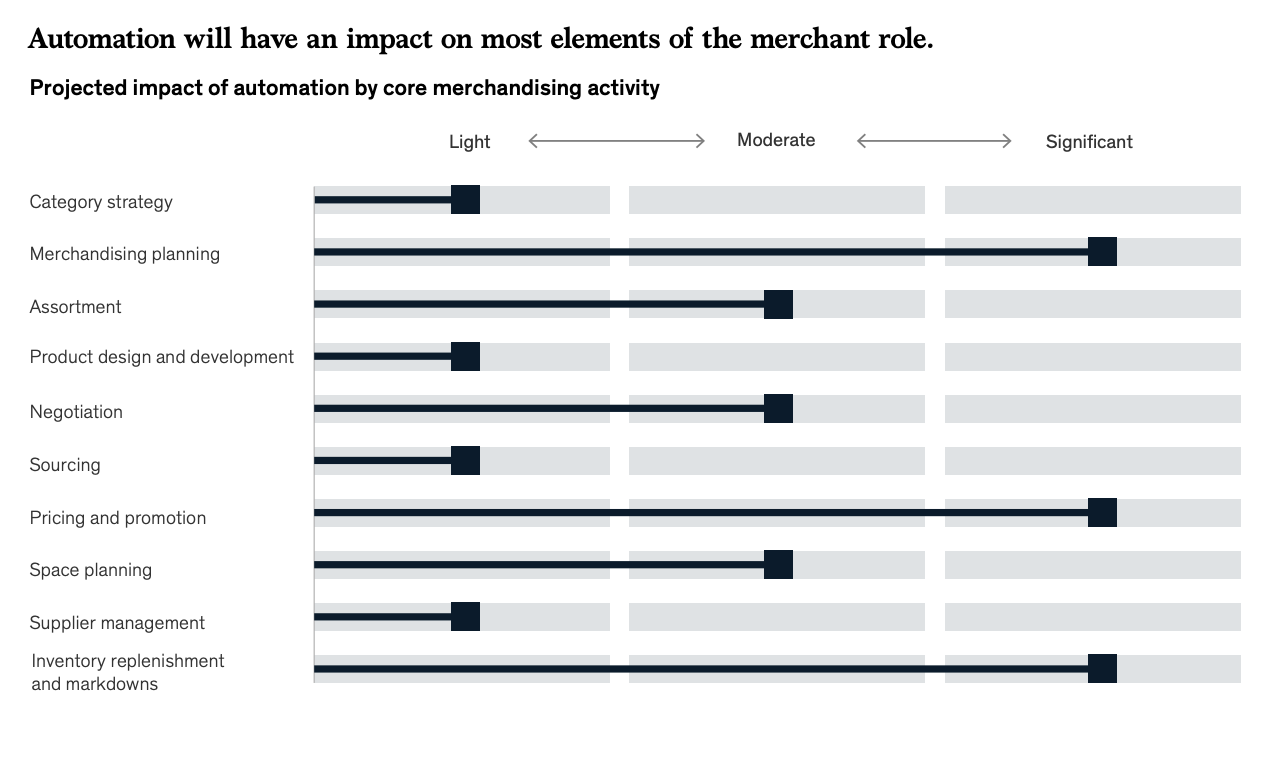

Assortment

-

-

- Reimagine value for money: price, private label, quality, branding, merchandising.

- Capture new needs: health, safety, fresh, new ready to eat; reduce exposure to highly discretionary categories.

- Adapt formats to new needs: polarization in pack size (large and single packs) and hygiene certainty.

- Rethink brand mix: increase exposure to post-COVID-19 loyalty-shift winners (trusted A-brands and local brands), and simplify assortment.

-

How Shopping Behavior is Changing

Shopping behavior has changed dramatically because of COVID-19. Brands are now being forced into what Mckinsey calls the “Fight to Online”. Here are three main data points Mckinsey found on how shopping behavior is changing:

-

- Digital Shopping is here to stay.

- Categories, where expected growth in online shoppers exceeds 35 percent, include essentials such as over-the-counter medicine, groceries, household supplies, and personal care products.

- Millennials and high-income earners are in the lead when it comes to shopping online.

- Consumers are switching brands are an unprecedented rate.

- Shoppers have cited a number of reasons for switching brands, with availability (in-store and online), convenience, and value leading the pack.

- Digital Shopping is here to stay.

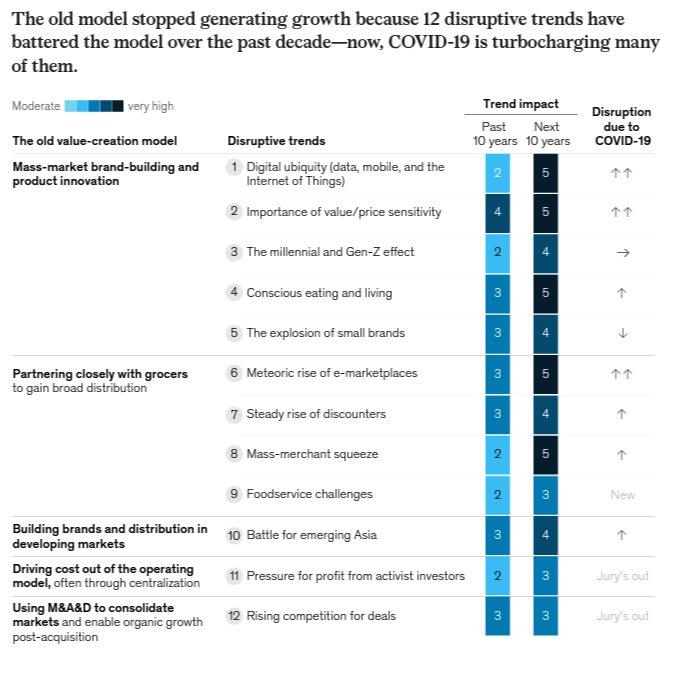

12 Disruptive Trends Hurting Traditional Business Models

Why hasn’t the old success model continued to grow? Because the model has been pummeled by 12 disruptive trends during the previous decade. COVID-19 has intensified most of them.

The New Model

Traditional consumer business models are becoming obsolete. More and more companies are realizing they must innovate to a new model in order to remain competitive and “win.”

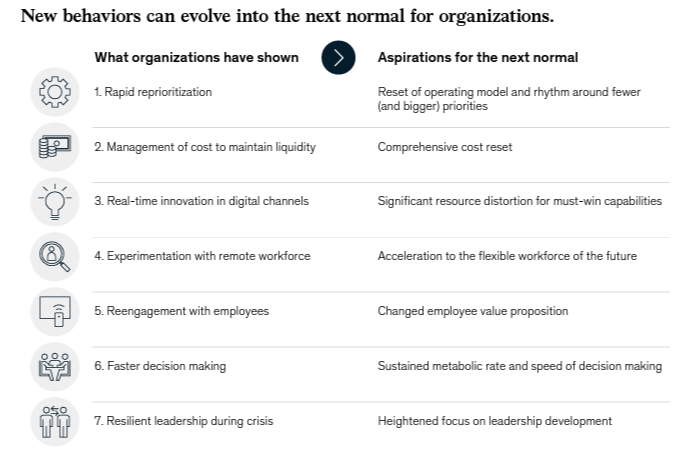

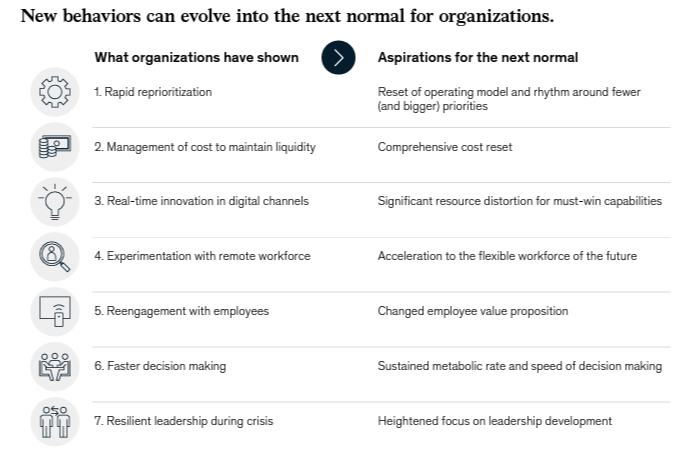

The seven shifts of the next normal

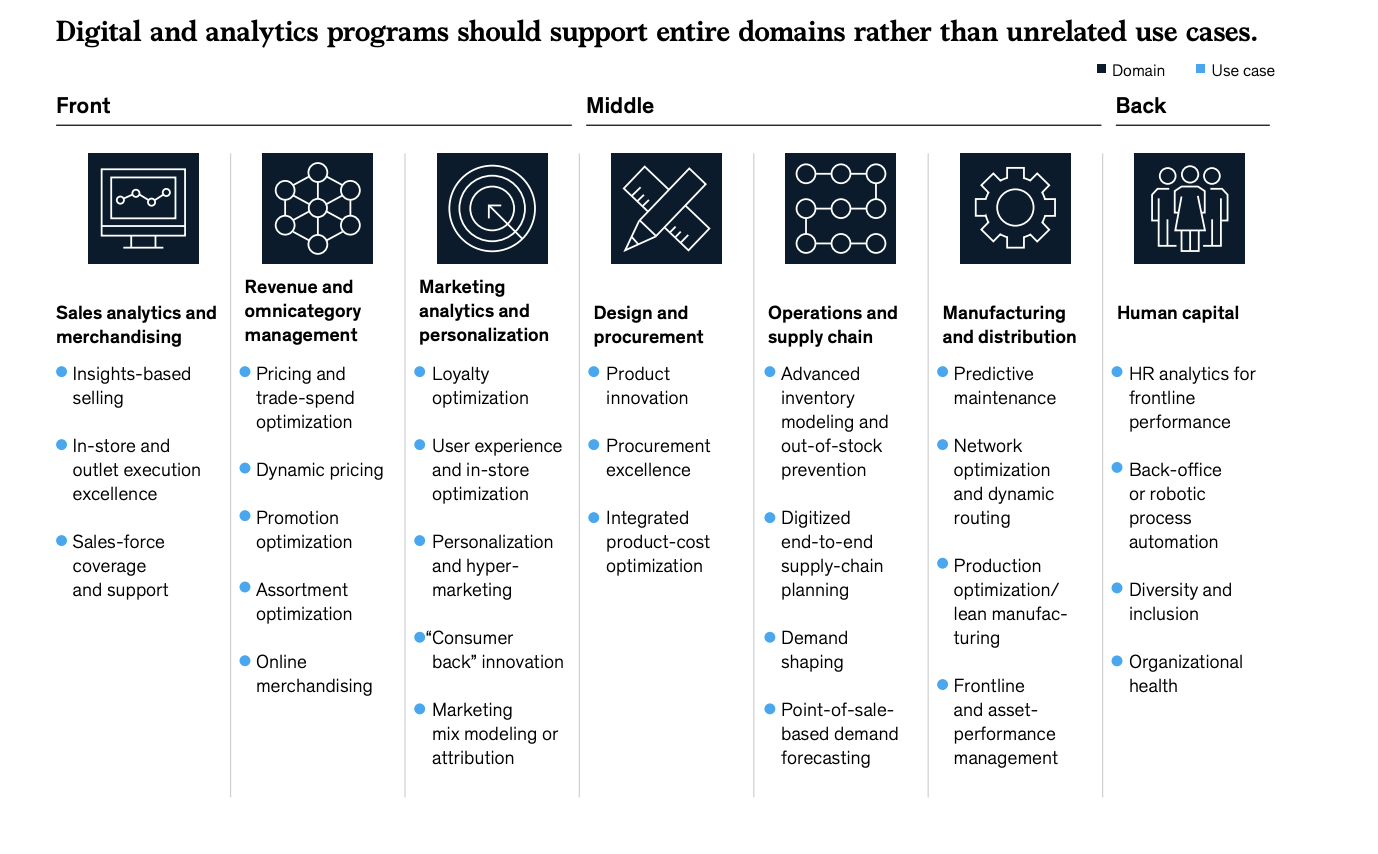

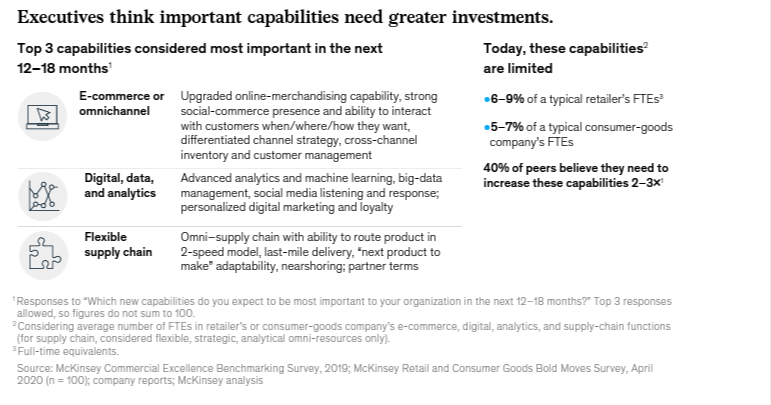

Accelerating the Recovery in Consumer Goods Through Digital and Analytics Programs

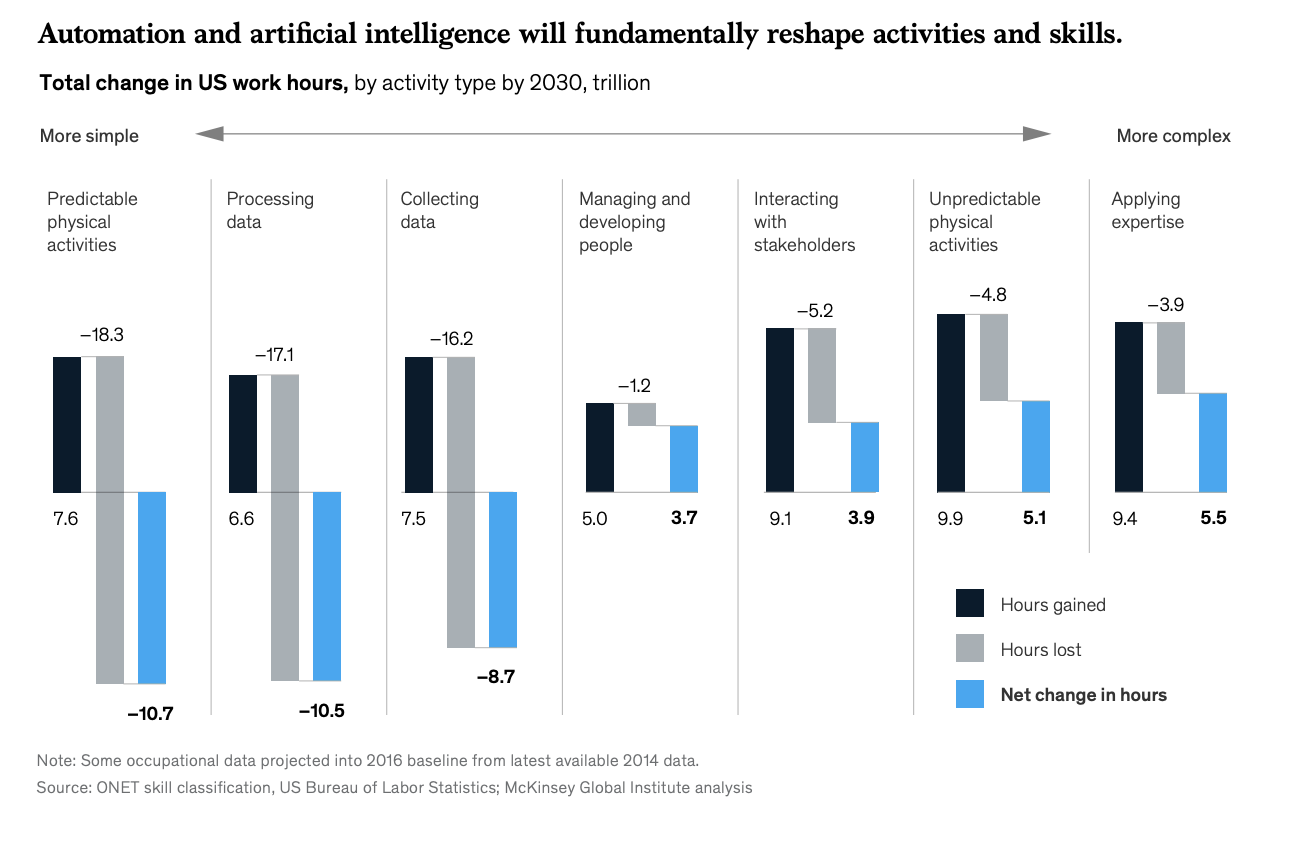

Is your Management Team Preparing for the Future of Work?

Questions to consider:

-

- What is the size and scope of the workforce that would be affected by your road map and technology?

- What business changes or adjacencies could generate significant new jobs?

- Do you have a plan to train people for the skills of the future? Do you need partners?

- Given the workforce implications across the economy, would you prefer to address them proactively or reactively?\

- Do you have a plan to source new talent at all levels of the company?

- How do wages need to evolve so that you retain workers and attract good talent?

CEO Prospectives on COVID-19 and Digital Transformation

Nick Vlahos, CEO of Honest (Consumer Goods)

-

- “Consumers are spending their money on brands they believe they can trust.”

- “By giving the consumer an experience that connects with how they shop and by creating solution sets that meet her needs, we start to create stickiness and loyalty to our brand.

- “We’re constantly listening and responding to the wants and needs of our customers.”

Hubert Joy, CEO of Best Buy

-

- “My personal experience is different. When we started the turnaround, I was very clear about my philosophy, which was that profit is not the purpose but that purpose is to contribute to the common good. We did not spend time in the first three years of the turnaround on refining our purpose. We spent the time saving a ship that was sinking, by addressing key operational-performance drivers.”

- “We spent a lot of time on making sure that the soil of the company was fertile. A lot of our emphasis was on creating a joyous, growth-oriented culture, on creating a very human environment where people felt that they belonged, that it was a human organization, that we emphasized individual development.”

- “The purpose of Best Buy, in relation to customers, is not just to sell you a TV or a computer – though we’d gladly help you buy one. But it goes beyond that. It’s about what we call enriching lives through technology by addressing key human needs. The reason people buy a computer or a phone is not really for the product, it’s for what it can do.”

Daniel Zhang, Alibaba Group CEO

-

- “We are a data-driven company. We create value from the data generated by the real activity of users and merchants; we use data as fuel for our marketplaces to help merchants better serve their customers. That is our logic, and we have been working on this for many years.”

- “Technology and data empower our whole business— not only on the sales side and marketplace side but also in the back-end office, in customer service, in every single area. This is how we work.“

- “In this digital era, when we talk about Alibaba’s future, we focus on helping our business partners win through successful digital transformation, rather than about how we can make ourselves even stronger. When small businesses can grow faster and grow healthier, it will benefit the whole society.”

- “We give our people a lot of space to try new things. It means you have to accept mistakes. The vast majority of innovations will result in failure; you have to acknowledge that”

Time to Go Digital

When all these trends come together, it is clear that COVID-19 has required companies to make dramatic changes. Now is the time to go digital, and there are several products that can help you achieve business and customer success.

Salesforce created Consumer Goods Cloud to help the industry digitally transform their business to accel now and in the future. Salesforce Consumer Goods Cloud offers you an intelligent and powerful solution to help you manage key accounts, deliver intelligent growth, optimize field execution, Salesforce TPM, and accelerate time to value across your entire organization.

About Corrao Group

Since 2002, we have been helping B2B organizations of all sizes optimize their business processes with Salesforce and their third-party applications. As everyday Salesforce power users, Corrao Group understands how flexible the Salesforce platform is to support every business department. We’ve worked with nearly 1,050+ customers, implementing, customizing, and optimizing over 2,150+ Salesforce projects. If you are interested in learning more about how Corrao Group can help your company, read our reviews on G2!

Sources

All photos via Mckinsey